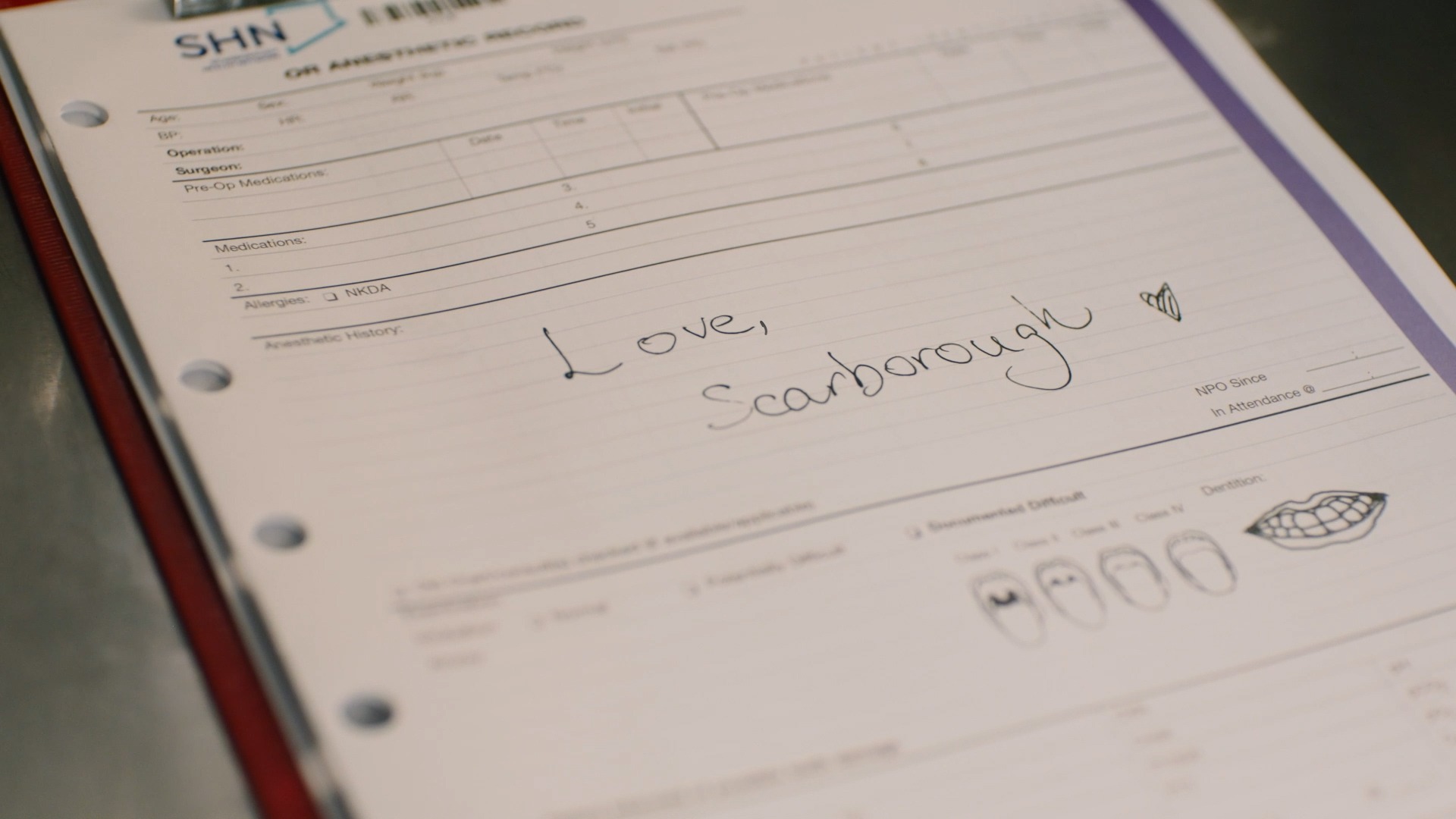

Estate Planning & Legacy Giving

Charlie and Iris Chan are Legacy Donors who decided to add SHN Foundation to their will.

Click here to learn more about their story.

When family and friends are cared for, we hope you will remember Scarborough Health Network (SHN) Foundation in your estate plan. A gift by will is a deeply personal, forward thinking way to support our mission and ensure the best of care for the community today, tomorrow and in the many decades to come. Through careful planning, you can make a charitable gift in your Will with minimal reduction to the inheritance for your children, maintain financial security during life, and disinherit the taxman at the same time.

A growing number of people have found that combining lifetime giving with a future gift is especially rewarding. We welcome the opportunity to work with you and your advisor to develop a gift plan that will be personally meaningful to you and bring maximum benefit to you and SHN Foundation. You can consult directly with us to have a custom clause prepared for you or have your lawyer call us to discuss your plans in confidence.

If you have already included or plan to include us in your Will, please fill out the Legacy Gift Confirmation Form. Return it by email to vchen@shn.ca, or mail it to Scarborough Health Network Foundation at 3030 Lawrence Ave. E., Suite 314, Scarborough, ON M1P 2T7.

A legacy gift, commonly known as bequest, is a future gift that designates a portion of your estate as a donation to a charity such as Scarborough Health Network (SHN) Foundation. Most legacy gifts are made through Wills. A Will is a legal document that allows you to decide how your assets will be distributed after you pass away, as well as how your dependents and pets will be cared for.

Like most Canadians, you’ve probably spent a lifetime contributing to a cause that’s close to your heart. Now imagine making a bigger contribution than you ever thought possible, without using any of the money you need during your lifetime, or significantly taking away from your loved ones. By giving even a small portion of your estate to SHN Foundation, you can take care of your family while making a significant impact for future generations. You can have the best of both worlds with a charitable gift in your Will. And we can show you how.

1. Simply include Scarborough Health Network Hospital Foundation in your Will. The donation can be a percentage of your estate, or residual gift (what is left of your estate after your loved ones have been cared for and all expenses paid), or a sum of money, or a piece of property such as real estate, jewelry or art.

2. Following your death, Scarborough Health Network Foundation will receive the bequest and issue a tax receipt to your estate to offset taxes.

• Retain control of your assets during your lifetime

• Make a significant contribution with minimal reduction to the inheritance for your loved ones

• Reduce the amount of taxes to be levied against your estate after you pass

• A bequest is revocable and can be modified if your financial circumstances change

“To pay to Scarborough Health Network Foundation (Canadian charitable registration number: 11914 2263 RR0001) _______% of the residue of my estate [or the sum of $____________]. This gift is to be used for such purposes and designs as deemed appropriate by Scarborough Health Network Foundation.

1. Talk it over with your family and loved ones

2. Speak to your lawyer about drafting or revisiting your Will, or adding a codicil

3. Inform us of your bequest by filling out and returning the Legacy Gift Confirmation Form so that we can show our appreciation. Of course we respect your privacy and confidentiality.

For more information, please contact:

Verna Chen

Associate Vice President, Gift & Estate Planning

314 – 3030 Lawrence Ave. E.

Scarborough, ON M1P 2T7

Telephone: 416-438-2911 ext. 6040; Cell: 416-219-5789; Email: vchen@shn.ca

IMPORTANT INFORMATION FOR YOUR LAWYER

Our legal name: Scarborough Health Network Foundation

Charitable registration number: 11914 2263 RR0001

Address: 314 – 3030 Lawrence Ave. E., Scarborough, ON M1P 2T7

Sample bequest for a general gift:

“To pay to Scarborough Health Network Foundation (charitable registration number: 11914 2263 RR0001) _______% of the residue of my estate [or the sum of $____________]. This gift is to be used for such purposes and designs as deemed appropriate by Scarborough Health Network Foundation.

Sample bequest for designating a gift to a specific hospital:

“To pay to Scarborough Health Network Foundation (charitable registration number: 11914 2263 RR0001) _______% of the residue of my estate [or the sum of $____________]. It is my wish that my bequest be used to support ____(hospital name)____________ (e.g. Centenary Hospital), for such purposes and designs as deemed to be of the highest priority by Scarborough Health Network Foundation.

If you would like to further direct your gift to a specific area or program, please contact Verna Chen, Associate Vice President, Gift & Estate Planning, 416-219-5789, or vchen@shn.ca

The information provided is general in nature, and does not constitute legal or financial advice, and should not be relied upon as a substitute for professional advice. We encourage you to seek professional legal, estate planning and/or financial advice before deciding upon your course of action.

To assist you in planning and creating your legacy, download the following documents:

- Sample Will Wording

- What Is A Codicil?

- Gifts Of RRSPs And RRIFs

- Gifts Of Life Insurance

- Gifts Of Securities

- Gifts of Property

- Legacy Gift Confirmation Form

Frequently Asked Questions

A gift in your Will is a meaningful way to affirm your values and leave a lasting footprint of your generosity and compassion in the world by giving to a cause you care about.

A bequest gives you the comfort of knowing your assets are available today, while enabling you to leave a larger gift than might be possible in your lifetime. Donors tell us how wonderful they feel knowing that their support for SHN can continue, even after they’re gone.

Your gift will

– Provide stable funding to meet the needs of patients for the long term.

– Help purchase life-saving medical equipment such as ventilators, portable ultrasound, baby heart monitor, etc.

– Upgrade aging facilities for better patient experience

– Help attract the best medical professionals we so desperately need.

All bequest gifts have the power to transform the future of health care in Scarborough.

Some people think that including money to a charity in their Will is only an option for the very wealthy. That isn’t the case!

The majority of charitable gifts in Wills are left by Canadians of average means. You may be surprised to find that when all of your assets (e.g. your house, your life insurance policy, your jewellery, your retirement funds, your TFSA…) are added up, you, too, will have a tidy sum for supporting both your loved ones and your favourite causes.

A Will is the easiest, most effective way to ensure the people and causes you care about are provided for and your assets are distributed according to your wishes. A properly crafted Will can also reduce, even eliminate, the taxes on your estate and the burden on your beneficiaries.

The name to include in your Will is Scarborough Health Network Foundation. Our charitable registration number is 11914 2263 RR0001

There are many ways to leave money to a charity in your Will, but these are the two most common:

• Residual bequest: Commonly designated as all or a percentage of the estate’s residue, a residual bequest refers to what is left in an estate after all debts, bills and taxes have been paid and all specific gifts have been distributed.

• Specific bequest: A specific bequest is a gift of a specific dollar amount, or asset such as a house, car, or securities.

You have more power to make a difference than you realize. By giving even a small portion of your estate to charity, you can make a significant impact on the causes you care about, and still support those you love. In short, you can do both.

We encourage you to first consider an unrestricted bequest, which gives us the flexibility to deploy funds where it is needed most. However, if you do decide to designate your gift to a specific hospital or program, contact Verna Chen at 416-438-2911 ext. 6040 or via email at vchen@shn.ca. Verna will help you with the wording and ensure that your gift goes where you want it to after you pass.

Other than a gift in your Will, you can help SHN Foundation by:

• Designating SHN Foundation as the beneficiary and/or owner of a new or existing life insurance policy;

• Naming SHN Foundation as the beneficiary of your pension plan, RRSP, RRIF, or TFSA;

• Making a gift of property such as real estate.

Stocks, bonds, mutual funds or other securities are ways to invest in a healthy financial future. You can transform those assets into a gift that helps ensure the health of the hospital, as part of a tax-smart donation strategy.